News & Updates

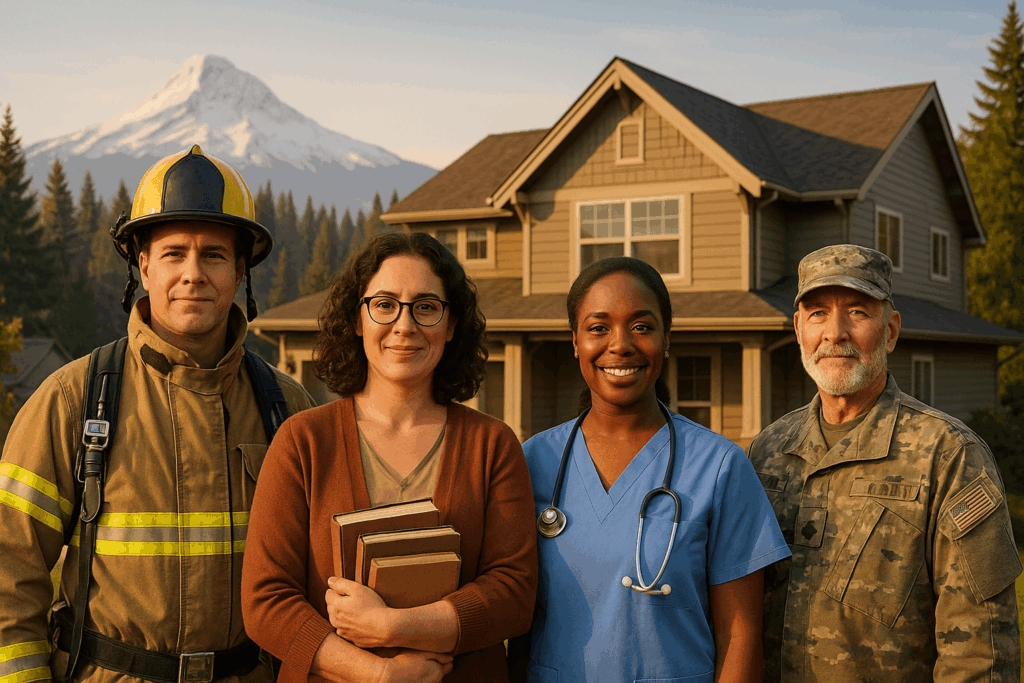

Who Qualifies for Homes for Heroes in Oregon? Complete Eligibility Guide

Discover if your service qualifies you for exclusive home buying benefits and significant savings with the Oregon Homes for Heroes program. From Portland's largest employers to rural communities, thousands of Oregon professionals are eligible. If you're reading...

Your Guide to the Homes for Heroes Program in Oregon

From Portland's tech corridors to Bend's mountain communities, Oregon heroes are realizing significant savings when buying, selling or financing a home through the Homes for Heroes program designed specifically for Firefighters and EMS, Law Enforcement, Military...

The Legacy of Kellogg Bowl: Milwaukie Oregon Historic Bowling Alley

Discover the historic Kellogg Bowl Bowling Alley's legacy in Milwaukie, a beloved landmark from the past.

2025 Goals: Turning Your New Year’s Resolution into a New Home

The new year has arrived, making it the ideal moment to map out your goals for 2025. If finding a new home is on your wish list, you’re in luck! Wondering where to begin? Relax—we’re here to guide you every step of the way. With a clear, actionable game plan, we’ll...

Mortgage Rates & News – Week of 1-13-2025

Rates Last Friday's jobs report was tough on rates. Mortgage bonds ended the day -61bps and we're down another 12bps this morning. Important notes for understanding and using this information: Any site/chart that advertises...

Mortgage Rates & News – Week of 1-6-2025

🎉 Happy New Year! 🥳Rates Rates are a smidge higher than last week's average. Nothing to be too worried over, yet. Important notes for understanding and using this information: Any site/chart that advertises rates (like the above) is showing a national average...

Mortgage Rates & News – Week of 12/30/2024

Rates 🎉 Happy New Year! Markets close early Tuesday and reopen Thursday. We woke up to a nice rally today. As of now, mortgage bonds are up 36bps, the equivalent of about .125-.25% improvement in rate. The consensus is that the large swings last week and this week...

Mortgage Rates & News – Week of 12/23/2024

🎄 Markets close early Tuesday and reopen Thursday. Happy holidays! 🎄Rates Rates are up after last week's Fed meeting: Important notes for understanding and using this information: Any site/chart that advertises rates (like the above) is showing a national average...

Mortgage Rates & News – Week of 12/9/2024

Rates As of Monday morning, rates are up a tick from Friday’s closing: Important notes for understanding and using this information: Any site/chart that advertises rates (like the above) is showing a national average for one very specific loan scenario, as reported...

Mortgage Rates and Housing Back in The Waiting Game

After embarking on a volatile journey in early October, the past 2 weeks have been calmer for mortgage rates.